A 360º view of Swiss pension payments: Lump-sum withdrawals to Overseas Scheme Members.

Lump-sum withdrawals can be for considerable amounts of money – high fees and uncompetitive foreign exchange rates risk seriously impacting the final amount received by expatriate scheme members located outside Switzerland.

As time critical ‘one off’ payments connected to key life events they require careful planning and execution.

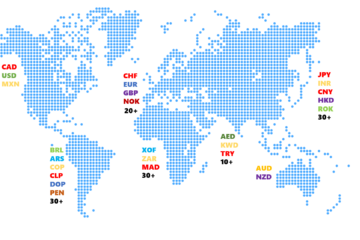

Ebury delivers Lump Sum payments efficiently and answers key questions that many Banks and payment providers are unable to:

Currency Risk

Do you know how much your members actually receive and whether this represents ‘good value’?

Transaction Costs

Overseas lump sum pension payments can incur high bank deductions and delays, particularly if they are routed through multiple banks.

Ebury challenges this by offering transparency around costs and foreign exchange margins and operates its own payment network..

Fraud Risk

The growth in cyber-crime and fraud is a key risk to pension funds.

The growth in cyber-crime and fraud is a key risk to pension funds.

Ensuring you pay the right person and have robust measures to protect them as part of their customer experience offers peace of mind and protection for both Pension Funds and their members.

ID Verification provided by myPensionID, using biometric technology on a mobile phone can support this process anywhere in the world to help with:

Proof of Life – Existence Checks

New Bank account instructions – cutting a process that can take weeks to verify

Managing Returns from deceased members

Proof of Payment

Do you need proof of payment?

The delivery of automated confirmation emails to the beneficiary – offers reassurance prior to crediting their account.

To help the pension fund to close the file and the beneficiary for instance with a tax declaration.

A simple analysis of your existing process using our skills and expertise can give you this assurance. We would welcome the opportunity to discuss how Ebury Mass Payments and AB Exchange can deliver increased benefits to your members and efficiencies for your operation.