Business case: The Challenge of Paying in Argentina, Colombia and Brazil

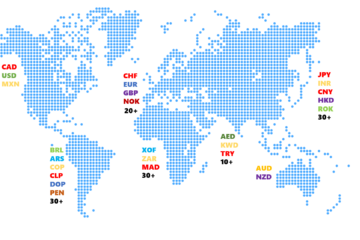

In today’s global economy, cross-border transactions have become routine, but they often come with challenges, especially when dealing with exotic currencies like the Argentine Peso (ARS), Colombian Peso (COP), or Brazilian Real (BRL). These currencies can fluctuate rapidly, and each country has its own regulations and payment requirements.

Ebury Online Platform provides a simplified process where users can easily access exchange rates, book trades, and schedule the payment, all while ensuring same-day delivery.

By utilizing a secure online portal, payments can be made in a matter of hours, helping businesses manage cash flow and avoid delays.

One of the key advantages of the service is the ability to manage multiple currencies in real time. Users can book trades to secure competitive exchange rates and lock in prices, eliminating the risks associated with currency fluctuations. Additionally, the platform allows to keep track of the payments and stay compliant with local regulations, such as taxes or reporting requirements.

For instance, in Brazil, businesses must comply with the Central Bank’s rules on international transfers, which require detailed documentation for each transaction.

Enhancing Same-Day Delivery of Payments

When it comes to urgent payments, time is of the essence. We offer the same-day delivery, ensuring that payments are processed quickly and efficiently, even for exotic currencies. This is particularly important for businesses that need to meet strict payment deadlines, such as suppliers or international contracts.

Conclusion

Paying in USD in exotic currencies like ARS, COP, and BRL may seem daunting due to local regulations and currency fluctuations, but with the right tailor-made solution, businesses can efficiently handle payments in these markets. By utilizing an online platform to book trades and schedule same-day delivery, businesses can ensure their payments are processed promptly, while remaining fully compliant with local regulations. This provides a seamless, reliable, and transparent way to handle cross-border transactions in exotic currencies.