Cross-border payments

Business case: The Challenge of Paying in Argentina, Colombia and Brazil

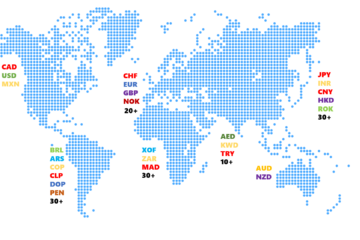

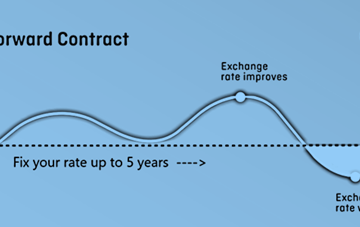

In today’s global economy, cross-border transactions have become routine, but they often come with challenges, especially when dealing with exotic currencies like the Argentine Peso (ARS), Colombian Peso (COP), or Brazilian Real (BRL). These currencies can fluctuate rapidly, and each country has its own regulations and payment requirements. Ebury Online Read more…