Flexible Forward

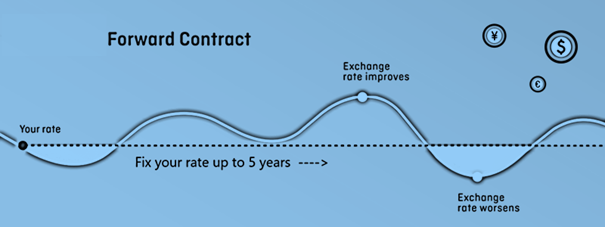

A flexible forward contract [open forward contract] is an agreement to buy or sell a specified amount of one currency against payment in another currency on or before a specified date in the future known as the ‘value date’.

In a flexible forward, the funds can be exchanged in one go (“outright”). Alternatively, several payments may be made over the course of the contract provided that the entire amount is settled by the maturity date.

For example, a Swiss company knows it will have to pay a number of invoices from a supplier based in the Eurozone during next year. I can decide to purchase a 12-month open CHF-EUR forward contract, allowing it to make drawdowns to pay the supplier in euros in any moment all over the year.