Hedging currency risk

If you are an importer or exporter in Switzerland you are exposed to currency risk.

We can help you to plan your income and expenditures on international transactions more effectively.

The FOREIGN EXCHANGE RISK MANAGEMENT is key to ensure the financial health of your company:

Identify and avert risk in unstable market conditions

Achieve clear budgeting

Protect your profit margins from foreign currency fluctuations

What is a FORWARD TRADE?

A forward trade is a FX transaction in which the exchange rate is set NOW but delivery takes place at a FUTURE DATE (with us up to 60 months).

The exchange rate of the transaction is calculated with the spot of the pair of currencies and adjusted according to the interest-rate differential of this pair of currencies.

If you know where you will spend your money, it may make sense to hedge your assets.

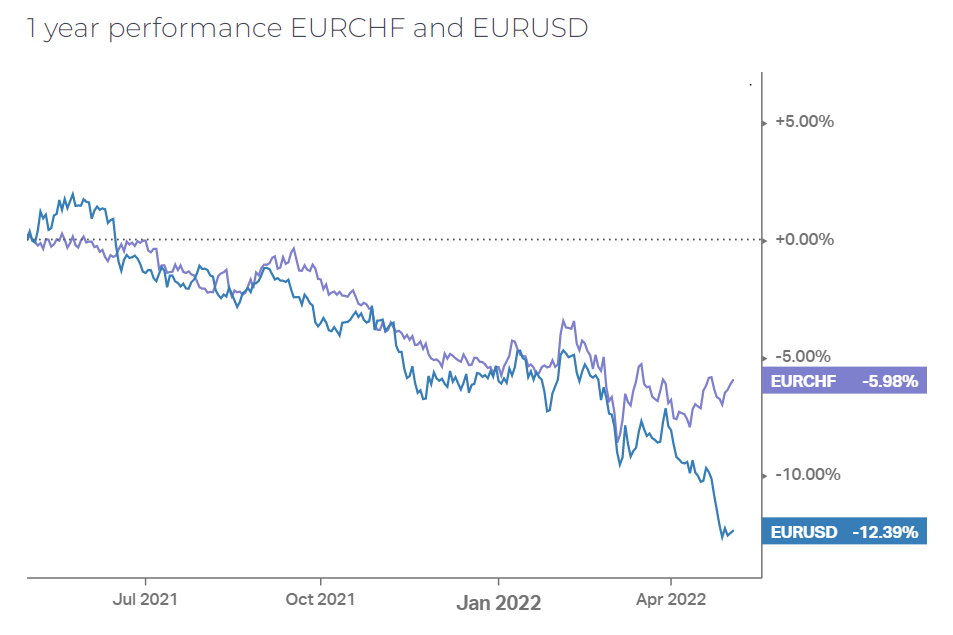

For example if you are a Swiss company, you will likely spend CHF. So, if the CHF gets too strong against other currencies, your foreign future accruals may lose their value in CHF or you may increase your prices in other countries. In that case, to reduce your margin volatility, you could hedge some portion of the future expected sales to reduce that risk.

You can check different pair of currencies in our section markets with real time information.